Inheritance Rights for Surrogacy Children: What Are Their Inheritance Rights in Case of Intestacy?

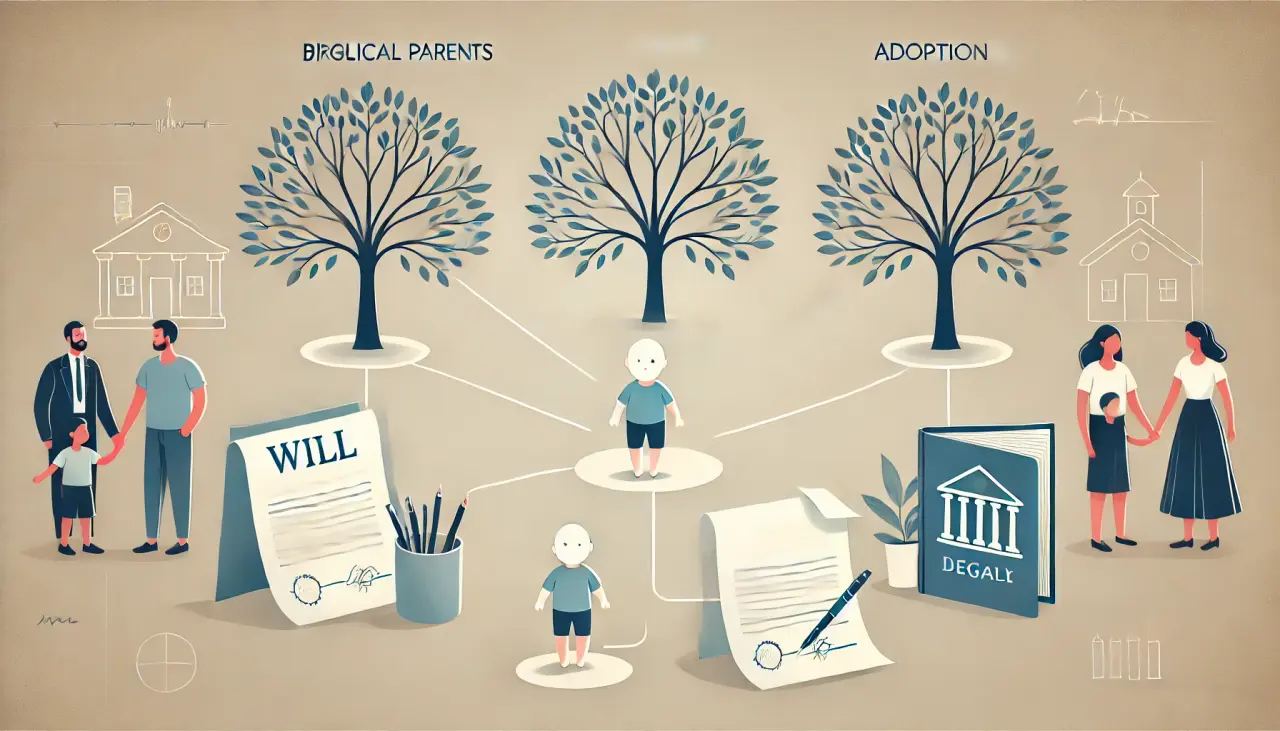

The question of inheritance rights for surrogacy children can be complex and varies depending on the legal framework in place. Generally, surrogate-born children inherit from their biological parents if recognized legally, but the situation changes if the child’s intended parents die without a will (intestacy).

Understanding the Inheritance Rights of Surrogate-Born Children

In many jurisdictions, a child born via surrogacy does not automatically have inheritance rights unless specific legal steps are taken. For instance, inheritance rights of surrogate-born children might be more secure if the intended parents legally adopt the child or if the surrogacy agreement clearly specifies the child’s status.

- Intestacy and Surrogacy:

In the case of intestacy (when someone passes away without a valid will), surrogate-born children might find themselves excluded from inheritance unless a legal adoption took place or a specific provision was made. In such cases, legal counsel might explore ways to assert the child’s inheritance rights under the applicable laws of Estates, Powers, and Trusts in the region. - The Role of Adoption in Securing Inheritance Rights:

Adoption plays a crucial role in securing inheritance rights for surrogacy children. If the child is formally adopted by the intended parents, they will have the same legal standing as any biological child in matters of inheritance. Without formal adoption, complications may arise, especially in intestacy cases. - Legal Ambiguities in Surrogacy and Inheritance:

While some legal systems may address inheritance rights of surrogate-born children in cases of intestacy, many do not explicitly address this situation. In such cases, an experienced attorney may be able to apply creative legal theories, ensuring the child inherits from the intended parents’ estate. - The Impact of Surrogate’s Bequests:

Another consideration is the possibility of a surrogate mother making a bequest to a child born through surrogacy. However, if the surrogate mother does not name the child specifically or legally adopt the child, issues of inheritance could be further complicated by intestacy laws. - Estate Planning for Surrogacy Families:

Intended parents seeking to ensure that a child born through surrogacy has inheritance rights should consider drafting clear wills and engaging in proper estate planning. This might include formal adoption or naming the child as a beneficiary in relevant legal documents to avoid any confusion in the event of the parents’ passing.

Frequently Asked Questions (FAQs)

- Does a child born through surrogacy automatically have inheritance rights?

No, a surrogate-born child does not automatically have inheritance rights unless steps such as adoption are taken or a legal provision is made by the intended parents. - What happens if the intended parents die without a will (intestacy)?

In cases of intestacy, a surrogate-born child may not inherit unless the child is legally adopted or named as a beneficiary. Legal counsel may be required to ensure the child’s rights are recognized. - How can a surrogate-born child inherit from the intended parents?

Inheritance rights for surrogacy children can be secured through formal adoption, estate planning, or a valid will that explicitly names the child as a beneficiary. - Can the surrogate mother leave an inheritance to the child?

If the surrogate mother chooses to make a bequest, the inheritance rights of the child would depend on whether the child has been legally adopted by the intended parents or named in legal documents. - What are the legal challenges in inheritance for surrogacy children?

Legal challenges arise when there is no adoption or will in place, potentially leaving a surrogate-born child without clear inheritance rights, especially in intestacy cases.